Media and Entertainment is a multi-trillion-dollar global industry. Latest forecasts suggest that Video – including traditional broadcast TV, traditional pay-TV, and OTT – will deliver about $700 billion of revenue in 2024. 50% of that revenue will come from advertising, 45% from subscriptions and 5% from public funding. Specifically in OTT video, the fastest growth area is in ad-supported services like AVOD, FAST, and especially in Broadcaster audiences moving to streaming.

While this sounds attractive, there are worrying dynamics for Broadcasters to address. To win the battle for eyeballs, it is now more business-critical than ever for Broadcasters to focus on delivering highly efficient, broadcast-grade streaming.

Audience Dynamics

Broadcast audiences are declining

Broadcast TV viewership has been in general decline for many years. Older age-groups consume the most content and are most loyal to broadcast, but a recent UK-focused Ofcom Media Nations presentation at the Future of TV Advertising event highlighted the continuing decline even in older age-groups.

The inevitable shift to online viewing

Multiple reports show that the youngest age-groups watch most content on video sharing platforms (e.g., YouTube, TikTok, Instagram), with SVOD/AVOD consumption (e.g., Netflix, Prime, Disney+) representing a bigger share of total viewership in the older 16-34 age-group. For under 34s, Broadcast TV represents only 25% of total viewing time, versus 90% in the Over 75 age group.

Research from Magna’s 2023 Time Spent Report highlights further generational differences, showing that content consumption on Connected TVs for Millennials (27-42 age group) and Gen Z (11-26 age group) is 200% higher than for Gen X (43-58 age group) and 400% higher than for Boomers (59-68 age group).

Whether it is the steady general increase in watching online video or the rapid increase from one major event to the next, the shift to streaming is inevitable.

Business Dynamics

Advertising is going online

Advertisers are taking more of their advertising budget online. Online ads can be targeted more effectively and find us while we are browsing websites. Critically they can be measured more easily than TV ads. It’s a clear reason to re-focus advertising budgets.

Worryingly for Broadcasters, a recent report from PWC highlighted that while Internet, Gaming, and VOD are all growing ad revenues with strong future growth expected, Broadcast TV has been flat and is forecast to be flat. Broadcast TV is moving from 30% of total global ad revenue in 2018, to 22% in 2023 and forecast to be just 19% in 2027.

Pay-TV is going off-satellite

Companies offering Satellite TV services are transitioning to streaming-first service propositions (e.g., Sky Stream and Sky Glass). For linear TV channels, Satellite distribution is becoming expensive. Industry statistics show a staggering decline from $100bn of global Satellite TV revenues in 2015 to $42bn in 2028. The shift from satellite to streaming is speeding up the overall consumer shift to streaming-first.

Pressure for TV’s Frequency is growing

The World Radio Conference 2023 (WRC 2023) was heralded as a moment when the Ultra-High-Frequency (UHF) band, used by Digital Terrestrial Television (DTT) services in the 470-694 MHz range would become “co-primary” use by Broadcast and Mobile.

This would have been a watershed moment in the broadcast industry and potentially marked an acceleration from DTT to streaming. However, the Conference decided to align with the EU’s and UK’s recommended position of “no change” to the primary use of the UHF band for broadcasting while adding mobile services as an optional secondary use of the frequency. This position will be reviewed at WRC 2031.

Despite this decision, the commercial reality is that consumers are buying new SmartTVs and faster broadband, and Broadcasters are offering new services on their streaming platforms. The pressure is on for the frequency, and business models are shifting anyway.

Competition from Pure-Play Streamers & Global Media

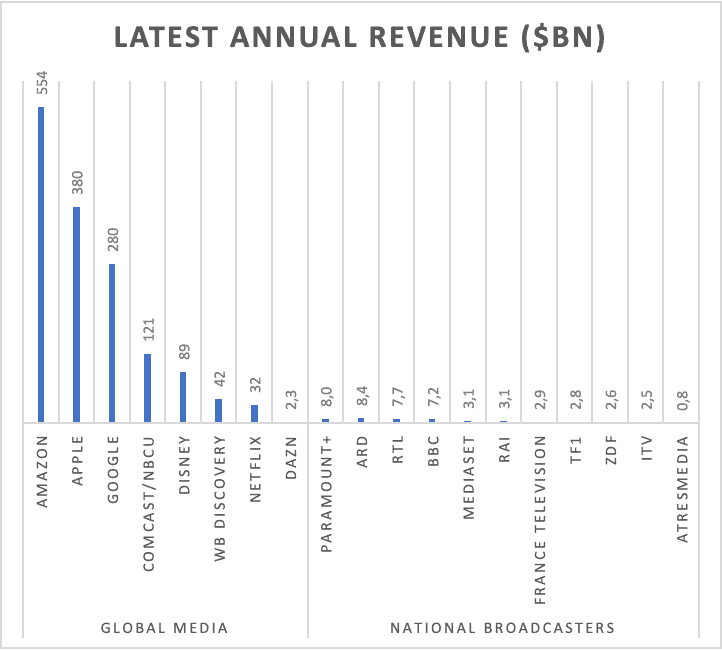

The biggest media companies in the world have much higher revenues than the large national and regional Broadcasters. Their long-term capability to invest in content, rights, talent and technology is self-evident.

Customer surveys of their services also show that they perform best for user experience and playback quality. This group is a significant threat to Broadcasters for the advertising and subscription revenues that make up 95% of the $700bn annual Video revenue.